Evergrande: Could it be the end of the road for the world’s most indebted property developer, as US$37 billion bill comes due?

- There is mounting fear about developer’s ability to repay piling debt against the backdrop of muted property sales and efforts by Beijing to rein in the property sector

- The company ‘is no longer a viable business’, say TS Lombard analysts

The second of a three-part series on China Evergrande Group takes a deep dive into the property developer’s total debt to see whether it can escape its liquidity crisis through property and asset sales.

But, the bill for that largesse is coming due, as fears are rising about its ability to repay its cascading pile of debt against the backdrop of muted property sales in mainland China and efforts by Beijing to rein in the property sector in the past year.

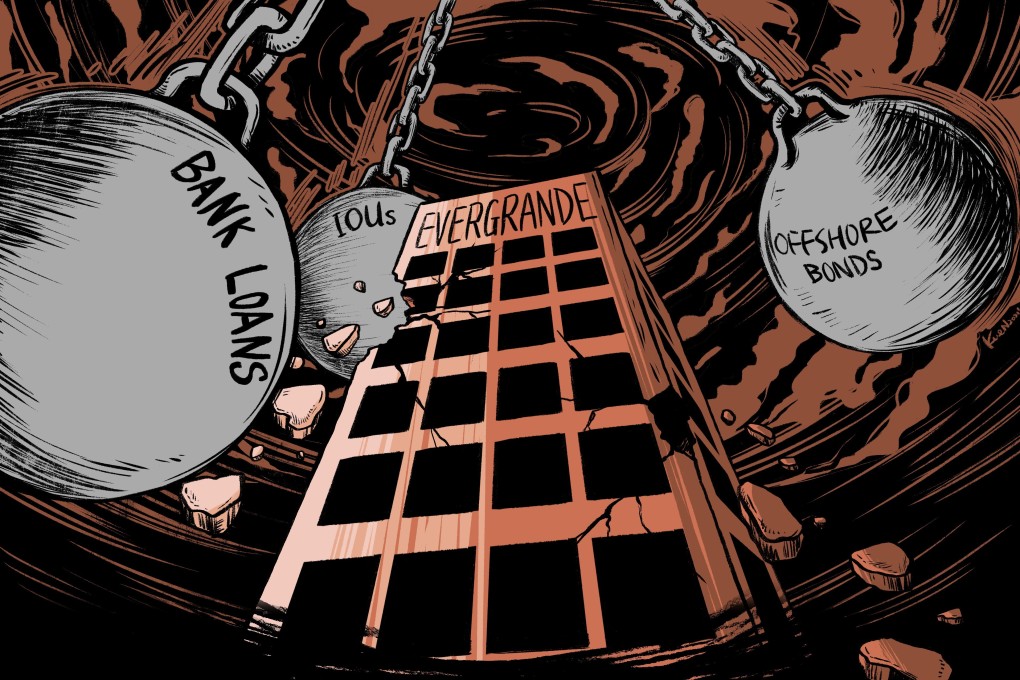

The developer’s property portfolio had 144 billion yuan (US$22.3 billion) worth of completed apartments, houses, commercial and retail spaces ready for sale as of June 30. But Evergrande faces a mountain of short-term borrowings, from bank loans to offshore bonds, totalling about 240 billion yuan, due by the end of June in 2022.

02:25

Unpaid by Evergrande, supplier sells car and home to rescue his business